"Vertical:Unleashing the Power of Vertical Integration" likely focuses on the concept of vertical integration and how it can unlock significant power. It may explore how companies can vertically integrate their operations by bringing together different stages of the supply chain, from production to distribution. This approach can lead to enhanced control over the value chain, improved efficiency, and potentially greater competitive advantage. By integrating vertically, companies can streamline processes, reduce costs, and better meet customer needs. It may also discuss the challenges and opportunities associated with vertical integration, such as managing increased complexity and adapting to changing market dynamics. Overall, the article aims to provide insights into the potential of vertical integration and how it can drive business success.

In the complex and ever-evolving business landscape, the concept of "vertical" holds significant importance. Vertical integration, in its various forms, has the potential to reshape industries, drive innovation, and create competitive advantages. This article explores the meaning and implications of vertical integration, highlighting its benefits, challenges, and real-world examples.

I. Understanding Vertical Integration

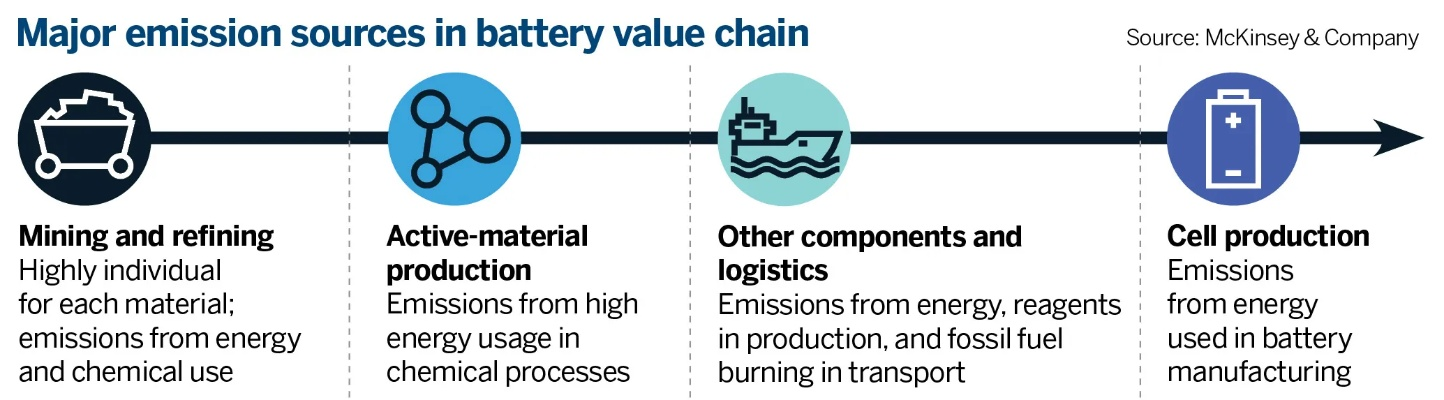

Vertical integration refers to the strategy of a company expanding its operations across different stages of the supply chain. Instead of relying solely on external suppliers or partners, a vertically integrated company takes control of multiple aspects of the production process, from raw materials acquisition to final product distribution. This can involve backward integration, where a company acquires or develops its own suppliers, or forward integration, where it enters into distribution or retail channels.

By vertically integrating, companies can achieve several key advantages. Firstly, it allows for greater control over the quality and supply of inputs. For example, a manufacturing company that vertically integrates into the mining of raw materials can ensure a consistent supply of high-quality ores, reducing the risk of disruptions due to supplier issues. Secondly, it can lead to cost savings through economies of scale and improved efficiency. Integrated companies can streamline production processes, eliminate middlemen, and optimize inventory management. Additionally, vertical integration can enhance a company's ability to differentiate its products and services. By having more control over the entire value chain, companies can offer unique features or better customer experiences.

II. Benefits of Vertical Integration

- Enhanced Supply Chain Management Vertical integration enables companies to have a more direct and efficient supply chain. They can closely monitor and manage the flow of materials, ensuring timely delivery and reducing lead times. This can lead to improved product quality and customer satisfaction. For instance, a vertically integrated electronics company can ensure that its components are sourced from reliable suppliers and assembled in a timely manner, resulting in a seamless production process.

- Cost Savings and Economies of Scale By integrating vertically, companies can achieve cost savings through economies of scale. They can optimize production, reduce waste, and lower procurement costs. For example, a vertically integrated food company can purchase raw materials in bulk, negotiate better prices with suppliers, and operate more efficiently in its production facilities. These cost savings can then be passed on to customers or used to invest in other areas of the business.

- Improved Product Differentiation Vertical integration gives companies the opportunity to differentiate their products and services. They can control the entire value chain and offer unique features or capabilities that competitors may not have. For example, a vertically integrated software company can develop its own hardware and integrate it with its software, providing a seamless user experience. This can give the company a competitive edge in the market.

- Increased Market Power Vertical integration can also increase a company's market power. By controlling multiple stages of the supply chain, companies can have more influence over prices, distribution channels, and customer relationships. They can also vertically restrict competition by preventing rivals from accessing certain parts of the value chain. For example, a vertically integrated pharmaceutical company may have the ability to control the supply of key drugs, giving it a significant advantage over competitors.

- Innovation and Technology Transfer Vertical integration can foster innovation and technology transfer within the company. By having more control over the R&D and production processes, companies can invest in new technologies and develop unique products. They can also transfer knowledge and expertise across different stages of the supply chain, leading to improved performance. For example, a vertically integrated automotive company may develop advanced manufacturing technologies that can be applied to its suppliers and other parts of the business.

III. Challenges of Vertical Integration

- High Capital Requirements Vertical integration often requires significant capital investment. Companies need to acquire or develop new facilities, purchase equipment, and hire additional staff. This can be a barrier for smaller companies or those with limited financial resources. Additionally, the upfront costs of integrating vertically can be difficult to recover, especially if the market conditions change.

- Increased Complexity Vertical integration adds complexity to the business. Companies need to manage multiple operations, coordinate different departments, and deal with a wider range of suppliers and customers. This can lead to inefficiencies and challenges in communication and coordination. For example, a vertically integrated company may have to deal with different production schedules, quality standards, and pricing strategies, which can be difficult to manage.

- Risks of Overextension Companies that vertically integrate too much can face the risk of overextension. They may spread their resources too thin, taking on too much debt, or overestimating their ability to manage multiple businesses. This can lead to financial difficulties and a decline in performance. For example, a company that acquires several unrelated businesses through vertical integration may struggle to integrate them effectively and achieve synergy.

- Regulatory Constraints Vertical integration can also face regulatory constraints. In some industries, regulators may be concerned about anti-competitive behavior or market concentration. They may require companies to divest certain assets or operations to maintain a competitive market. For example, in the telecommunications industry, regulators may require companies to separate their infrastructure and service providers to promote competition.

- Dependency on a Single Industry Vertical integration can make a company more vulnerable to changes in the industry it operates in. If the demand for a particular product or service declines, the company may suffer significant losses. Additionally, if the industry experiences technological disruptions or regulatory changes, the vertically integrated company may have a harder time adapting. For example, a vertically integrated newspaper company may struggle to transition to digital media in a rapidly changing market.

IV. Real-World Examples of Vertical Integration

- Apple Inc. Apple is a prime example of a vertically integrated company. It designs, manufactures, and sells its own products, including iPhones, iPads, and Macs. By vertically integrating, Apple can control the entire user experience, from the hardware to the software. It can also ensure the quality and security of its products, and offer unique features and services. Apple's vertical integration has been a key factor in its success, allowing it to command high prices and build a loyal customer base.

- Alibaba Group Alibaba is a leading e-commerce company that has vertically integrated its operations. It operates an online marketplace, provides cloud computing services, and has a stake in logistics and payment companies. By vertically integrating, Alibaba can offer a comprehensive suite of services to its customers, streamline the supply chain, and improve customer satisfaction. Its vertical integration has also enabled it to expand into new markets and drive innovation.

- Tesla Motors Tesla is a vertically integrated electric vehicle manufacturer. It designs and manufactures its own batteries, motors, and electric drivetrains, and has its own network of charging stations. By vertically integrating, Tesla can control the quality and performance of its vehicles, reduce costs, and accelerate the development of new technologies. Its vertical integration has been a key factor in its ability to disrupt the automotive industry and lead the way in sustainable transportation.

- Walmart Walmart is a retail giant that has vertically integrated its supply chain. It owns and operates its own distribution centers, has its own fleet of trucks, and has relationships with suppliers around the world. By vertically integrating, Walmart can offer low prices, ensure a consistent supply of products, and improve its logistics efficiency. Its vertical integration has been a key factor in its success as a dominant player in the retail industry.

- Amazon.com Amazon is a vertically integrated e-commerce and technology company. It operates an online marketplace, provides cloud computing services, and has its own logistics and delivery network. By vertically integrating, Amazon can offer a seamless shopping experience, streamline the supply chain, and drive innovation. Its vertical integration has been a key factor in its ability to disrupt the retail and technology industries and become one of the most valuable companies in the world.

V. Conclusion

Vertical integration is a powerful strategy that can offer numerous benefits to companies. It can enhance supply chain management, achieve cost savings, improve product differentiation, increase market power, and foster innovation. However, it also comes with challenges, such as high capital requirements, increased complexity, and regulatory constraints. Real-world examples like Apple, Alibaba, Tesla, Walmart, and Amazon.com have shown the potential of vertical integration, but it requires careful planning, execution, and management. Companies that can successfully navigate the challenges of vertical integration can gain a competitive advantage and drive long-term success in their industries. As the business landscape continues to evolve, vertical integration will likely remain an important strategic option for companies looking to stay ahead and create value.

京公网安备冀I陇ICP备2022000946号-1

京公网安备冀I陇ICP备2022000946号-1

还没有评论,来说两句吧...